Mergers & Acquisitions

+65 6601 8902

Overview

Making M&A Work

Making M&A Work

Have you or your organisation been presented with an acquisition or divestment opportunity? Are you preparing for potential growth or consolidation in the near future? You may be aware that merger and acquisition (M&A) transactions have a mixed track record, with many failing to deliver expected benefits, and some even leading to significant loss of value. And unless you are part of a very large organisation, you may have limited M&A experience and expertise within your leadership team.

This programme will help you and your team members develop a clear understanding of the underlying issues, strategic choices and ingredients necessary for ultimate M&A success. The programme takes you through an entire M&A lifecycle, beginning from crafting a growth strategy and target screening, to performing due diligence, and finally closing a deal. You will also learn to construct a strategic roadmap that will help you overcome the hurdles of post-deal integration and enable your organisation to realise the M&A deal’s full potential.

Although no prior experience in M&A is required, participants are expected to have some basic knowledge of accounting and finance – i.e. balance sheets, income statements and cash flow statements. The first day of the programme is an accounting and finance refresher, which can be opted out of depending on your profile and needs.

Core Focus

- Evaluating your business portfolio and identifying targets for acquisition or consolidation

- Clarifying the strategic promise of the combined or restructured entity

- Understanding valuation and due diligence issues

- Managing the deal, deal structure, contractual terms, and pre and post-deal risk allocation

- Making it work: 100 days and beyond

Key Benefits

- Understand underlying M&A issues and strategic choices

- Learn M&A best practices and avoid pitfalls

- Manage the deal and deal players

- Learn to formulate pre and post-deal strategic roadmaps

Faculty

Other Teaching Faculty

Guest Speakers & Instructors

Who Should Attend

Leaders and executives who have responsibility for, or who are involved in identifying, planning and/or executing M&A, including:

- Senior management

- Business development directors

- M&A team members in strategic planning, finance, legal or human resources

- Entrepreneurs

Past Participants

- Account Manager

- Finance Director

- Assistant General Manager

- Associate Director

- Business Development Manager

- Chief Financial Officer

- Director, Business Planning

- Director, Corporate Services

- Division Vice President

- General Manager

- General Manager

- Head of Group Strategic Planning & Business Development

- Manager, Market Analysis

- Manager, Structured Finance

- Managing Director

- Owner

- Partner

- Principal Technology Manager

- Regional Head, Corporate Business Development

- Regional HR Director, APAC & MEA

- Regional HR Manager

- Senior Global Director, Strategy & Planning

- Senior Relationship Manager

- Vice President

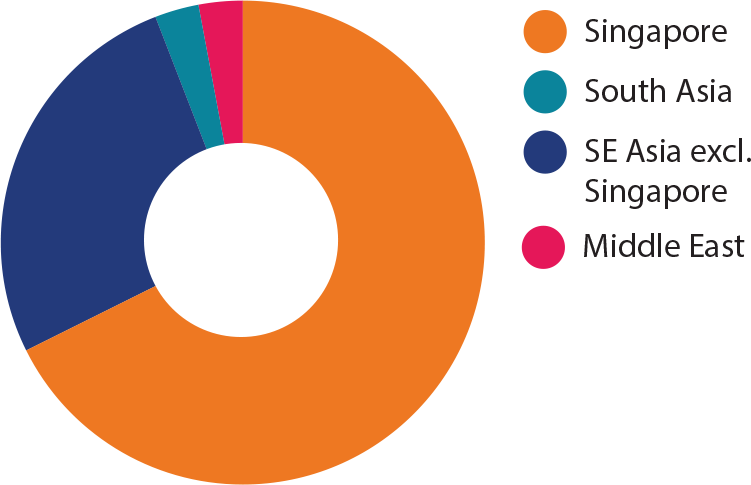

This is a comprehensive overview of the M&A process: from strategy to deal-structuring. The faculty is world-class and the content bridges theory with practice.Christopher Malone, United Arab EmiratesPartnerMonitor Deloitte

Well-rounded M&A course taught by the best people in this field. Definitely an eye-opener, and a good introduction for me to apply in my field of work.Andreas Subekti, IndonesiaVice Managing DirectorPT Deltomed Laboratories

Excellent and concise programme that covers sufficient critical areas necessary and useful for application in the actual work environment.Choo Kin Poo, SingaporeSenior Global Director, Strategy & PlanningCovance Inc.

Having some experience in M&A, this programme served to fill in some gaps in my knowledge.Lionel Wong, SingaporeRegional Head, Corporate Business DevelopmentSATS Ltd

High-quality facilities, top-notch treatment and dynamic content!Gilberto Cardoso, SingaporeManager, Market AnalysisBHP Billiton Marketing Asia

The overall M&A course structure was up-to-date and relevant to the current business environment.Mohammad Mohannad Alam Khan, BangladeshGeneral ManagerRobi Axiata Limited

Dates and Fees

Alumni / Early Payment / Team Enrolment Benefits

All NUS alumni and past participants of NUS Executive Education are entitled to 10% alumni savings on this programme.

Alternatively, you can enjoy savings if you pay early with Visa or MasterCard:

> 45 days before start of programme: 10% savings

> 30 days before start of programme: 5% savings

Team enrolment benefits are also available, please contact the programme advisor for details.

Application Deadline

- Participants are strongly advised to apply at least 2 months in advance

- Applications received after the deadline will be considered based on space availability